The fact that the telecommunications industry has challenges is not news. In fact, the challenges facing the industry with 5G today are not so different than those they faced when moving from 2G to 3G and from 3G to 4G as Ian Hunter reports.

5G is the next generation of mobile technology that will see our phones and devices download music and videos hundreds of times faster than 4G.

Potentially, a thousand times faster. We are talking about downloading a full HD film in one or two seconds.

5G has the potential to change the world as we know it. It will dramatically increase the speed at which data is transferred, improve response times and provide enough capacity for the billions of devices that will be connected in the internet of things (IoT), paving the way for a vast array of innovative new technologies and services.

Here in the UK, we won’t see 5G mobile networks and phones until sometime in 2020. Initially, it is likely to be launched in just one or a few cities. It’s currently way too early to say who will be the first network to launch 5G services. However, the first operator to launch 3G in the UK was Three and with EE first to launch a 4G network.

Everyone will need to upgrade to a 5G phone or device to be able to benefit from all the advantages that 5G will bring. The reason for this is that 5G will use different frequencies to both 3G and 4G, therefore your existing phone will not work.

It is in this area of frequencies or spectrum, where a lot of activity in the UK market is taking place right now with industry regulator Ofcom laying out the rules for their delayed auction that is now set to take place this autumn, a year later than originally planned.

Ofcom Rules - OK?

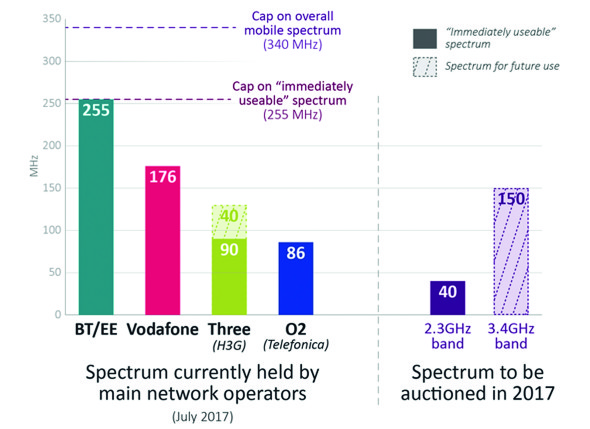

In July 2017 Ofcom published its rules for the auction of 5G spectrum and immediately ignited a row between the UK’s main MNO of BT, Three, Vodafone and O2 by setting a cap on the maximum amount of spectrum any single MNO can acquire.

The Ofcom rules impose two restrictions on bidders to limit the amount of spectrum dominant operators can win:

- No operator will be able to hold more than 255MHz of immediately usable spectrum, ie in the 2.3GHz band, following the auction.

- No operator will be able to hold more than 340MHz of the total amount of spectrum following the auction, equivalent to 37% of all the mobile spectrum that is expected to be useable in 2020. This includes spectrum available in this auction and in the 700MHz band.

By imposing a cap on the overall amount of spectrum Ofcom hopes to satisfy competition concerns while enabling all operators to develop 5G services, hence there is no limit on the amount of 3.4GHz spectrum a company can hold.

But that strategy is falling apart very quickly.

Ahead of the rules being announced there were calls from O2 and Three for tighter bidding restrictions to be imposed on EE and Vodafone, which currently control the biggest shares of mobile radio spectrum.

Three, owned by Hong Kong conglomerate CK Hutchison, had demanded rules to prevent any operator owning more than 30pc of the airwaves, regardless of their frequency.

O2 has called for a 35pc cap on total ownership, which unlike Three’s proposal would allow EE to bid for some of the 5G airwaves.

Following its £12.5bn merger with BT, EE currently controls around 45pc of mobile spectrum. That figure will drop below 35pc when the new licences are made available and EE is not happy about that at all.

However, O2 and Three claimed that to compete and maintain a market of four strong players they needed a greater share of the airwaves.

Meanwhile, restrictions on the ability of EE and Vodafone to bid risk triggering a legal challenge that could slow the process down.

Vodafone, which currently has a 28pc share of the airwaves, had told Ofcom it supports the auction rules as proposed. It added that a ‘safeguard cap’ should be considered in the 3.4GHz band to ensure EE does not completely dominate and there are at least two early investors in 5G.

So, in a nutshell, EE will seek a court ruling to get more than the Ofcom cap while Three and O2 will ask the court to reduce the cap to 30% to keep a flatter playing field. Only Vodafone appears to back the Ofcom plan as it stands.

The Spectrum:

Ofcom is initially planning to auction 190MHz of high capacity spectrum in the 2.3GHz 3.4GHz bands, comprising 40MHz in the 2.3GHz band and 150MHz in the 3.4MHz band. That amount is equivalent to roughly three-quarters of the spectrum auctioned by Ofcom at the 4G spectrum auction in 2013 and will increase the spectrum available for mobile devices by nearly a third. Spectrum in these bands is well suited to 5G, as it can carry large amounts of data.

The 2.3GHz spectrum will be available for immediate use by operators to provide extra capacity for their existing networks. The band is already supported by mobile devices from the likes of Apple and Samsung.

The 3.4GHz spectrum is not compatible with most current devices and will be used for the rollout of 5G networks. It has been identified as central to 5G rollout across Europe.

At a separate auction, Ofcom plans to auction 116Mhz of spectrum in the even higher bandwidth 3.6GHz - 3.8GHz bands, as well as in the 700MHz band.

Right now, there are many who talk about 5G and have unrealistic expectations for 5G, reminding many of us of dreamers from the days of 3G.

In order for 5G networks to succeed in the UK the technology needs to overcome two challenges. Firstly, as already covered, 5G needs sufficient new spectrum to be available and secondly it needs the right infrastructure over which to run the services to users.

If there is a to be a cap on 5G then many would say that has to be the sensible cap!

Robin Kent, director of European operations, Adax, a firm specialising in high performance packet processing, security and network infrastructure for Legacy to LTE networks.

Kent says that whispers about 5G are getting louder and expectations to implement it are increasing as it will serve to connect industries accounting for as many as 1.1 billion connections by 2025 according to the GSMA.

“The evolution through 2G to 4G has prompted rapidly increasing use of services and applications that are data heavy - and often the telecoms industry is struggling to keep apace. This illustrates that the industry has yet to fully implement a working and reliable 4G experience for users, which begs the question: can operators ensure 5G works sufficiently to provide a good consumer experience whilst making money?

Mobile data use has rocketed over the past five years – increasing 74 per cent alone in 2015. Behind this data explosion is the growth of streaming services, such as Netflix, and consumer’s growing use of apps – all underpinned by the expectation of having a high-speed data connection at all times. This rising expectation of ‘always connected’ consumers and the proliferation of multiple connected devices including self-driving cars and delivery drones are driving service providers to take the lead in the 5G race. Similarly, 5G’s support of IoT is another key driving factor for its high demand; after all, Gartner estimates that the amount of connected IoT devices will reach 26 billion by 2020. Three is ready to implement an overhaul of its network, which is likely to cost hundreds of millions of pounds per year over several years, to meet the demand for data as it prepares for 5G to be introduced.

Despite this data ‘demand’, there is still work to do in identifying the right business models and revenue opportunities to monetise 5G. With 5G theoretically 40 times faster than the hypothetical limit of 4G, it will take a great deal of expensive upgrading of

the current infrastructure to fulfil

its claims.”

Huge Investments

It is evident that the infrastructure overhaul will be huge – and expensive. The 5G roll out will require the current mobile networks to be more wired and the applications running on 5G need not just high bandwidth but low latency. Similarly, service providers must ensure they have the correct protocols in place to unlock the potential of 5G.

With this expensive upgrade in mind, Robin Kent says ‘will consumers be willing to pay more for 5G data to support this and if not, how will operators pay for this new infrastructure?’

“There is no clear plan as yet as to who will pay for this or how 5G can be monetised. If you look at the traditional business model, the service provider makes money from the subscriber, which the service provider then invests in new equipment and services. Yet, there is a danger of this chain being broken with 5G roll out. Service providers cannot guarantee that they will make money out of the subscriber because they’re not developing the new services for consumers to increase revenue. If service providers are going to play the long game, they have to understand where that monetisation can come from. If they get it wrong, it precludes them from making money further

down the line.”

Astronomical Impact

The 5G rollout will be an ‘astronomical’ leap forward says Mark Curtis-Wood, Head of Network Services at Nimans. But he warns that currently the technology remains a target for sceptics.

“I remember Mobile World Congress earlier this year when 5G got a bit of a panning with many commentators saying how we should still be focusing on 4G rather than something that may come further down the line. However, awareness of 5G is slowly starting to build and inevitably it is going to massively increase speeds, it’s just a question of when.

“I think the leap from 4G will be astronomical. You are talking about download speeds of 10,000 meg per second. It’s mind blowing! 4G can be provide hundreds of meg per second but 5G has the potential of thousands. It’s clearly a game changer.

There’s a bit of a buzzword at the moment around a gigabit smartphone on the back of what 5G will provide. Gigabit speeds on a smart device would have seemed crazy not that long ago. Another huge area that 5G will trigger is an avalanche of innovative services and applications that have been waiting for this type of connectivity. We saw it with 4G how higher speeds change user behaviour which in turn leads

to ever more sophisticated and powerful applications.”

Curtis-Wood concludes, “The requirement for more data becomes even more prevalent. Seeing is believing and the future of mobile technology is very exciting.”

Ed says...

Is the UK heading for a 5G bonanza come 2020 or is it likely to stumble in to a disorganised kind of village hall jumble sale? Any delay to the roll out of an effective national 5G service will disadvantage UK business and the economy. History is not exactly on our side here given previous form in the shape of a very jittery start to 4G. Although not welcome it is easy to understand why the four national carriers are jockeying for position ahead of the spectrum auction – once the fat lady has sung her song she won’t get back on her feet for an encore.