In the last couple of articles I’ve talked about ‘Value’. The value you can bring to a client over and above what you sell and the value you need to demonstrate to executives before they’ll engage with you. But there will come a time when a customer looks to measure, in financial terms, the value their investment with you has made to their business.

The most common metric for doing this ‘Return on Investment’; R.O.I. The challenge to sales people is the fact that a potential customer needs to calculate the R.O.I. before they make the purchase. A great sales person’s job should be to help a prospect build their financial justification, yet it still surprises me how many sales professionals don’t actually understand what R.O.I. is, or confuse it with something else.

When I discuss this during workshops, training events or with my personal coaching clients, the vast majority will say “R.O.I. is when a customer gets back the money they spent i.e. their investment is returned”. Logically that does sound correct, but it’s wrong. That’s actually another popular financial metric called Payback, not R.O.I.

R.O.I. is in fact the additional financial returns received after the initial invest is Paid Back, as a percentage of the original investment over a given period of time e.g. 3 or 5 years.

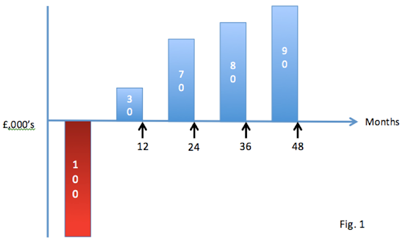

Let’s do the maths. In Fig. 1 above, when is Payback?

You should have calculated 24 months, as that is the point in time (because Payback is measured in time) when the investor has been paid back their investment.

Now calculate the ROI…

Actually you can’t, because I haven’t given you a time period over which to calculate it. Different thresholds will give you different answers. Customers will have a defined period over which they calculate R.O.I. and you must know this before you can progress. Using the above example, the possible R.O.I.s are as follows:

2 Years – 0%

3 Years – 80%

4 years – 170%

To be accurate in my teaching, this is what is often referred to as Basic R.O.I. as there are other factors that affect the value of the money that is returned over those years. This creates something called Net Present Value, NPV, but for now, let’s keep it simple.

What’s the Quickest and Easiest Way to Improve This Basic R.O.I. Calculation?

Discount! As soon as you reduce the amount going out, not only does the Payback period shorten but the R.O.I. calculation improves. In the above example, we would now see some R.O.I. by 24 months depending on the discount applied to the initial price.

This is one of the reasons why prospects always ask for discount, it’s an easy way to improve the financial justification, but YOU pay the price.

I trust these simple explanations help clarify the difference between these fundamental financial metrics. If nothing else it should avoid either an embarrassing situation through the incorrect use of this terminology, or at best prevent losing credibility in front of a Finance Director/CFO.

Next month I’m going to continue this discussion on R.O.I. and show why discounting is so detrimental to your business and should be avoided at all costs!

Brian Conway - www.ChannelSaleMastery.com