Comms Business Magazine met up with Richard Tang, Founder and CEO of Zen along with Steve Warburton his Managing Director, Indirect Markets to find out what their strategies will be to gain market share in the forthcoming fibre ‘land grab’.

When we last met Richard Tang it was at their Autumn partner conference at the Belfry and there Tang had described a ‘land grab’ for market share of fibre connectivity which he was predicting would occur between 2015 and 2020.

We asked how Zen characterised the market for connectivity today.

There are four key players ‘slugging it out’ in the fibre connectivity market; BT, SKY, Talk Talk Business and Virgin and between them they have 90% of the market. There’s a massive gap before you get to the ‘rest of the best’ Kcom, Daisy, Gamma, Entanet and of course ourselves.

BT is in a great position – FTTC is BT’s way of getting their market share back and after all they were first in this market.

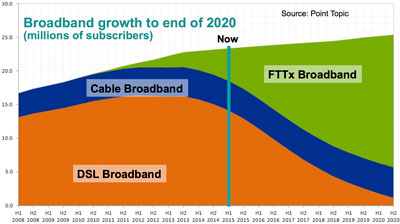

Every new or change of technology brings with it a wind of opportunity. There are around 23 million broadband connections today and over the next two or three years at least two million will change to fibre. If you look at the graph there’s a middle ground where from 4 to 13 million connections will provide quick growth. There will be a technology grab as cabinets go live with fibre and ISPs pounce on the opportunity.

So why should the channel work with Zen on this fibre grab?

“Zen is like ‘Tesco Finest’, if you pay a little more what you get is the best ISP service in the UK – our ethos is to do the job better each day.

Amongst the key players, especially the big four, there will be tremendous pressure on price which inevitably results in poor service being delivered.”

So where are the opportunities for resellers in all this?

Now is the time for resellers to fibre enable their customers but look beyond that connectivity to a range or bundle of services. Examine your customers’ IT infrastructures and take a look at cloud based applications, move them to VoIP and remote data back-up for example. There is a great cross sell opportunity opening up for resellers but connectivity is the enabler.

At the recent partner conference Zen said it aims to own the ‘personal service’ space in the market – is it there for the taking?

The channel has witnessed the issues and problems caused by ISP’s buying smaller providers - difficult to retain staff and merging networks and systems causes a lot of pain. All the focus is on growth but is there enough attention on the quality of the service provided?

Zen is positioned as an independent stable provider focussed on offering a premium service. We invest heavily in recruiting experienced people from the industry, training them to give them the right skills and adopt an approach that is all about ‘solving customer problems’ without heavy focus on KPIs such as our average call length, number of calls per agent and maximum call length etc.

Callers can tell when they are being given the ‘hurry up’ on the phone and will never get that from Zen.

Do you think the channel get lost in price and technology and loses sight of easing partner and customer pain?

There’s certainly been a race to the bottom on price by many suppliers as well as a lot of technology hype but where is the benefit to the reseller in this?

Cloud is no use without good access to it and customers want to get what they pay for in the form of reliable service that is well supported with no/low contention.

There’s a trend towards a one stop shop as customers reduce the number of suppliers which poses a treat as well as an opportunity and partners want a supplier that is easy to do business with so they can focus on providing their service wrap.

For service providers it’s about making sure you stand out from the crowd.

So what’s different about your service?

In our case the quality of our service has been our key differentiator and will continue to be the case. I also think in recent years the fact we are privately owned and crucially, stable is very attractive to channel partners stung by partnering with a provider only for them to be acquired or have a significant change of direction, affecting the quality of the service.