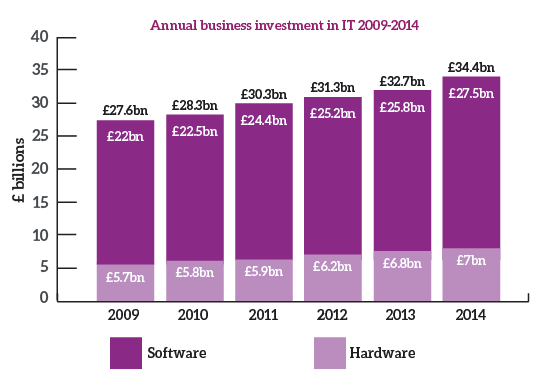

Business investment in IT hardware and software has hit a record high, up by a quarter since the financial crisis according to BNP Paribas. Software investment now accounts for 80% of spend.

Business investment in information and communications technology has hit a new record high, jumping to £34.4 billion last year – up by a quarter (24%) since the height of the recession in 2009, when businesses’ IT capital spending was just £27.6bn, according to BNP Paribas Leasing Solutions.

These figures include computer hardware, computer software and telecommunications equipment. Included are private sector businesses excluding education and healthcare and the figures are based on Office of National Statistics information.

BNP Paribas Leasing Solutions says that private sector IT investment has now far exceeded its pre-crisis peak of £30.9bn in 2008.

BNP Paribas Leasing Solutions says that private sector IT investment has now far exceeded its pre-crisis peak of £30.9bn in 2008.

According to the company, this growth is being driven by investment in software, which has jumped by 6% in the last year alone from £25.8bn in 2013 to £27.5bn in 2014. In the first quarter of this year, businesses spent £6.9bn on software.

Software now accounts for 80% of businesses’ IT capital expenditure, up from 74% ten years ago.

Tristan Watkins UK Country Manager for BNP Paribas Leasing Solutions says, “Investment in software is surging ahead because while most hardware has become relatively cheap and increasingly standardised, developments in software are advancing all the time.

Whether that’s industry- or application-specific software such as accounting or design packages, supply chain management programmes or sophisticated security software, businesses know that the right software will help them to be more efficient or provide better customer service than their competitors.”

As you might expect, the finance firm says that Managed IT services funded by leasing can help businesses keep IT costs under control.

BNP Paribas Leasing Solutions says that as investment in IT continues to rise, it expects to see further growth in businesses’ use of ‘managed services’, with small and medium sized IT suppliers taking advantage of leasing to enable them to offer managed services to a wider range of businesses.

The managed service model allows businesses to keep IT costs under strict control by outsourcing much of their IT requirements for a transparent all-inclusive monthly fee.

The same supplier provides configuration, network, security, training and maintenance services, along with the hardware and software and warranties. The fixed monthly payment can be better for cash flow compared to paying for equipment and support needs individually up front.

However, unlike cloud-based solutions, which offer some of the same advantages, there is no need for the buyer’s IT facility to be managed off-site. This is particularly important for businesses handling sensitive information and data.

Tristan Watkins explains, “With businesses increasing their capital investment, they want to keep their IT budget under strict control, but without the worries about data security that could come with switching to the cloud. Combining a monthly fee with an on-site service would offer the best of both worlds; helping businesses to keep any in-house IT function lean, and acquire expertise that they do not have themselves, without running up unexpected and unbudgeted costs.

Unfortunately too few small to mid-sized IT suppliers have been able to provide this sort of service, because it means funding costs like hardware, software, installation and consultancy upfront. Only the largest suppliers – typically working with the biggest organisations - are able to do that.

Leasing can help smaller IT suppliers to put these packages together, wrapped into a single fee. The leasing provider can fund all of the initial costs, which only leaves future costs such as on-going maintenance to be funded by the supplier.

For IT vendors, being able to provide a managed service helps them to build valuable, long-lasting customer relationships. They prove their expertise by providing on-going support, making them a valued partner not just a one-off supplier. The predictability of the monthly payments is also an attraction.

Vendors are increasingly asking us about the financing packages that we can provide to make all this possible.”